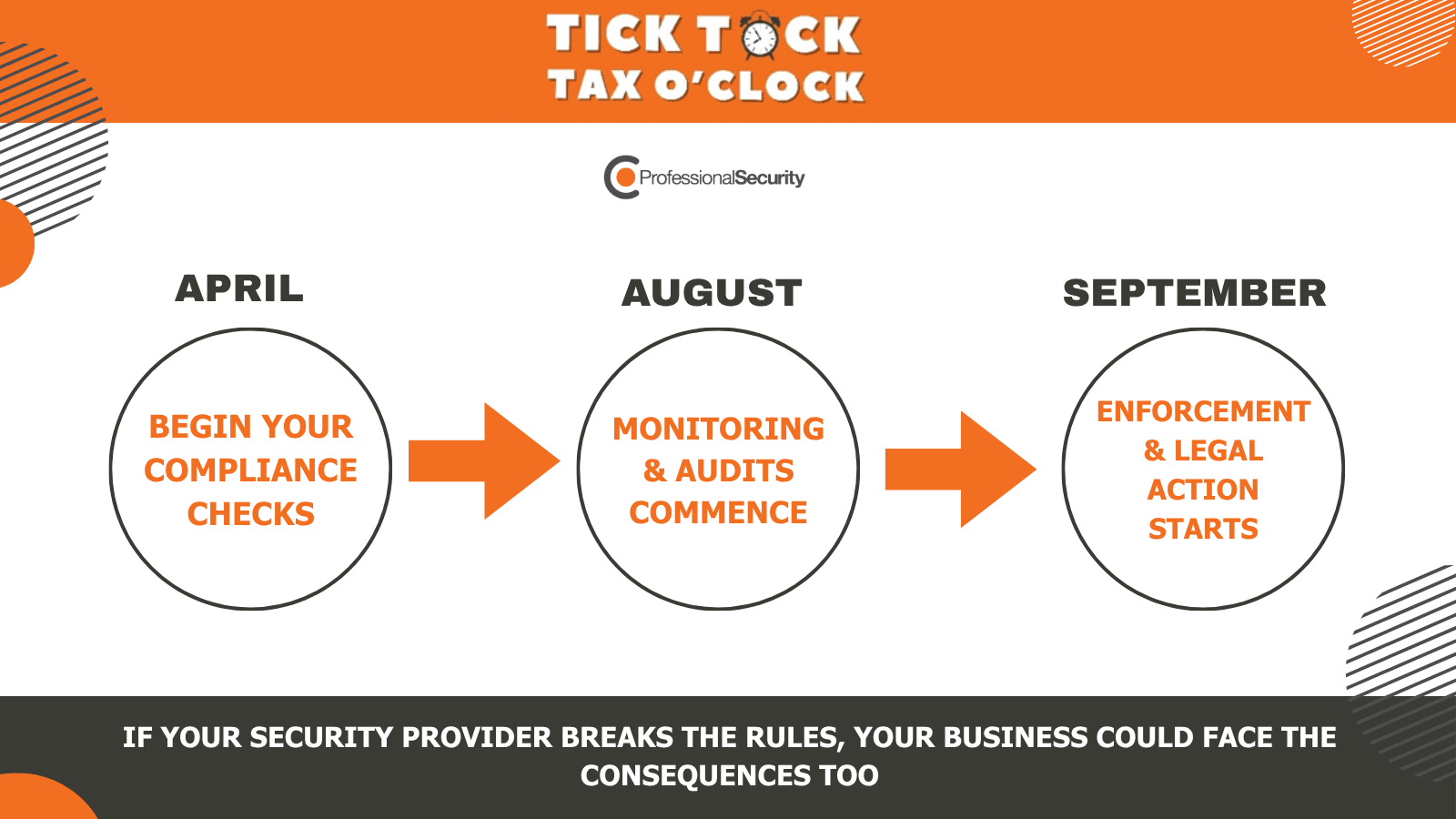

HMRC Is Coming and You Could Be Held Liable

HMRC has made it clear: if your security provider is non-compliant, and you haven’t done proper due diligence, your business is also at risk.

- HMRC can shift a supplier’s unpaid tax onto you

- You could lose your right to reclaim VAT

- You may face prosecution under the Corporate Criminal Offence Act

- Your brand could suffer permanent reputation damage

This isn’t just about paperwork. This is about real business risk: legal trouble, financial exposure, operational disruption and serious questions from customers, auditors, and the press.